Wages for maternity leave. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule.

Get Deep Knowledge With Hr Payroll Training Course Training Courses Payroll Training And Development

Membership of the EPF is mandatory for.

. If your Bonus was issued in January the EPF MTD contribution should pay on the subsequence month before February 15th. Section 431 EPF Act 1991. Received your bonus or commission but wondering about the large deductions that are incurred.

6 September 2017. The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 which manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. EPF Contribution Rates for Employees and Employers.

Ii it is made in respect of employees monthly wages. Any contribution payable by the employer towards any pension or provident fund. Payments Subject to EPF Contribution In general all monetary payments that are meant to be wages are subject to EPF contribution.

The extent of the employers obligation to contribute is limited in 2 ways. A gift of money During festival Not considered as personal income. After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age.

For payment of arrears of contributions employers are required to use the Form EPF 7 Form E and Form EPF 8 Form F except for contributions in respect of salary revision which are required to be paid together with the current monthly payment by using the same Form EPF 6 Form A. 03 Mar 2021 EPF members in the private and non-pensionable public sectors contribute to their retirement savings through monthly salary deductions by their employers. Any gratuity payable on discharge or retirement of the employee.

Salaries Payments for unutilized annual or medical leave Bonuses Allowances except a few see below Commissions Incentives Arrears of wages Wages for maternity leave Wages for study leave. Contribution Mandatory Contribution Last updated. All renumeration or wages stated below and payable to staffworkers are subject to SOCSO contributions.

Bonus and Angpow are it the same. 102000 - Total Ordinary Wage subject to CPF for the year Equivalent to 17 months x Ordinary. Payment in respect of unutilized annual or medical leave.

Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as the EPF a social security fund established under the EPF Act to provide retirement benefits to employees working in the private sector. Payments for unutilised annual or medical leave. Additionally the following list of payments must be included when calculating EPF contributions for employees in Malaysia.

Section 2 of the EPF Act 1991 provides for payments which are subject to EPF contribution include-. Any sum paid to cover expenses incurred by the employee in. Monetary payments that are subject to EPF contribution are.

Bonus is an performance based reward and will be recorded at payroll EPF and PCB while Angpow is a token of happiness during festive season proof-of-receive through signing of payment voucher hence it is not an income and. For example employee A earns RM6000 per month as their basic salary. Find out how to calculate your Malaysian Bonus Tax calculations.

Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. Jul 26 2018History Introduction In 2009 Malaysias income tax moved to a Monthly Tax Deduction MTD or Potongan Jadual Bercukai PCB. Arrears of salaries.

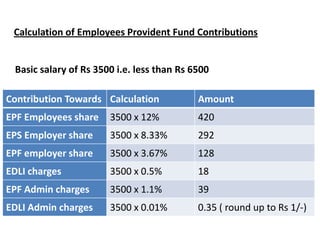

However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021. The rate of contribution is 12 each from the Employee with a matching contribution from the Employer. The Employee contribution is completely allotted to Employee Provident Fund EPF while the Employer contribution is bifurcated between EPF 367 and Employee Pension Scheme EPS 833.

In short yes bonuses and cash allowances are considered to be part of your wages. The Additional Wage ceiling is applied on a per employer per calendar year basis. For the month of September they receive a bonus of RM250 as.

In general all monetary payments that are meant to be wages are subject to EPF contribution. These contributions comprising the members and employers share will be credited into the members EPF account. For example annual performance bonus.

Salaries Payment for unutilised annual or medical leave Bonuses Allowances with some exceptions Commissions Incentives Arrears of wages Wages for maternity leave study leave half-day leave Other contractual payments or otherwise. Salary Wages fullpart time monthlyhourly Overtime payments. Paid leave annual sick and maternity leave rest day public holidays Allowances.

Bonus subject to EPF with PCB use e-PCB calculator and Angpow is not. The Additional Wage ceiling limits the amount of Additional Wages that attract CPF contributions. I it is made for the benefit of employees only.

Subject to EPF MTD. Wages subject to SOCSO contribution. Independent contractors and payments that are not wages.

Late payment of contributions is subject to penalties. Paid maternity leave. Section 431 EPF Act 1991.

The payments below are not considered wages and are not included in the calculations for monthly deductions.

Epf Admin Charges Reduced From April 2017 Updated Epf Rates Simple Tax India

Epf Employees Provident Fund Scheme What Is Epf Scheme And How To Calculate Pf Balance

Awesome Certificate Of Completion Construction Templates

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Epf Vs Ppf Vs Vpf Ctc And Salary Slip India

Old Inactive Epf Account Should You Withdraw Or Continue Basunivesh

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

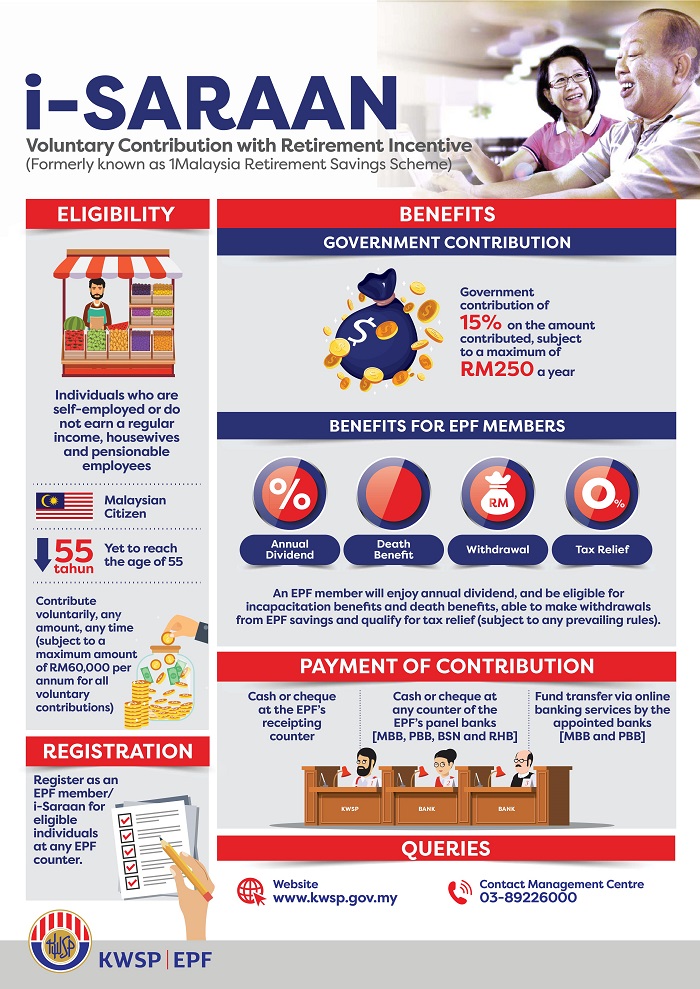

What You Need To Know About Epf S I Saraan

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

What Is The Pension Contribution In Epf Being An It Person Will I Get A Pension After A Certain Period Quora

What Is The Wage Limit For Epf There Are 45 Employees In My Company But The Management Is Not Giving Me Pf Saying That It Is Mandatory To Give Pf Only To

Epf Functions Schemes Epfo Interest Rate Epfo Latest News

What Payments Are Subject To Epf Donovan Ho

What You Need To Know About Epf Accounts Businesstoday Issue Date Feb 28 2013